Decentralized Escrow

Securing valuables with Escrow Smart contracts

Democratize escrow to add more trust in transactions through Smart contracts and DAOs

4 MIN READ - 15th DEC, 2020

What is a generic Escrow?

In traditional transactions, both the parties (payee and the payer)

are always concerned about foul play or mistrust. The payer is usually

concerned about the products/services they will receive and payee for

money being received. To fix this, an escrow is a financial

arrangement where a third party is responsible for regulating and

payment of funds which is required for multiple parties involved in a

given transaction. The third-party involved only release the funds

when all terms of the contract are respected. It helps in the

transaction being more secure as the funds are kept in an escrow

account which is managed by the

arbitrator.

Also, it adds an extra level of trust both parties have for the

Escrow so chances of foul play are less.

There are certain obligations

that need to be fulfilled before a payment is released and in case the

terms of the contract are not respected a dispute can be raised.

Escrow technology takes care of your transaction without fraud or risk

of losing money. It is always better to trust Escrow than making a

handshake deal which can result in foul play afterward.

How Escrow Financial Transaction Works?

A trustless process for smooth flow of transactions

Initially, either the payee or the payer approaches Escrow which acts as an arbitrator, the terms and conditions should be agreed upon before the transaction is started.

- The buyer puts the payment to escrow to purchase a product or service.

- Then, the seller ships the product or the service to the buyer.

- If everything works well, the buyer releases the funds to the seller. If not, a dispute can be created and the arbitrator will solve it.

What is an Escrow Smart Contract?

Can you see the future with those contracts?

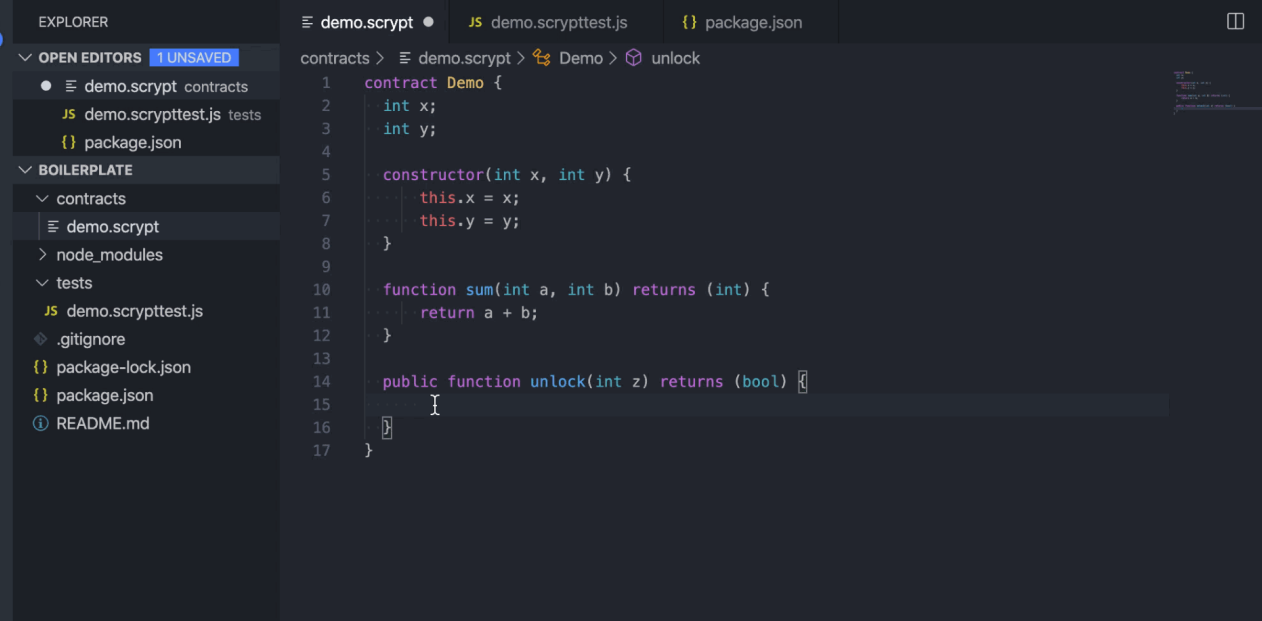

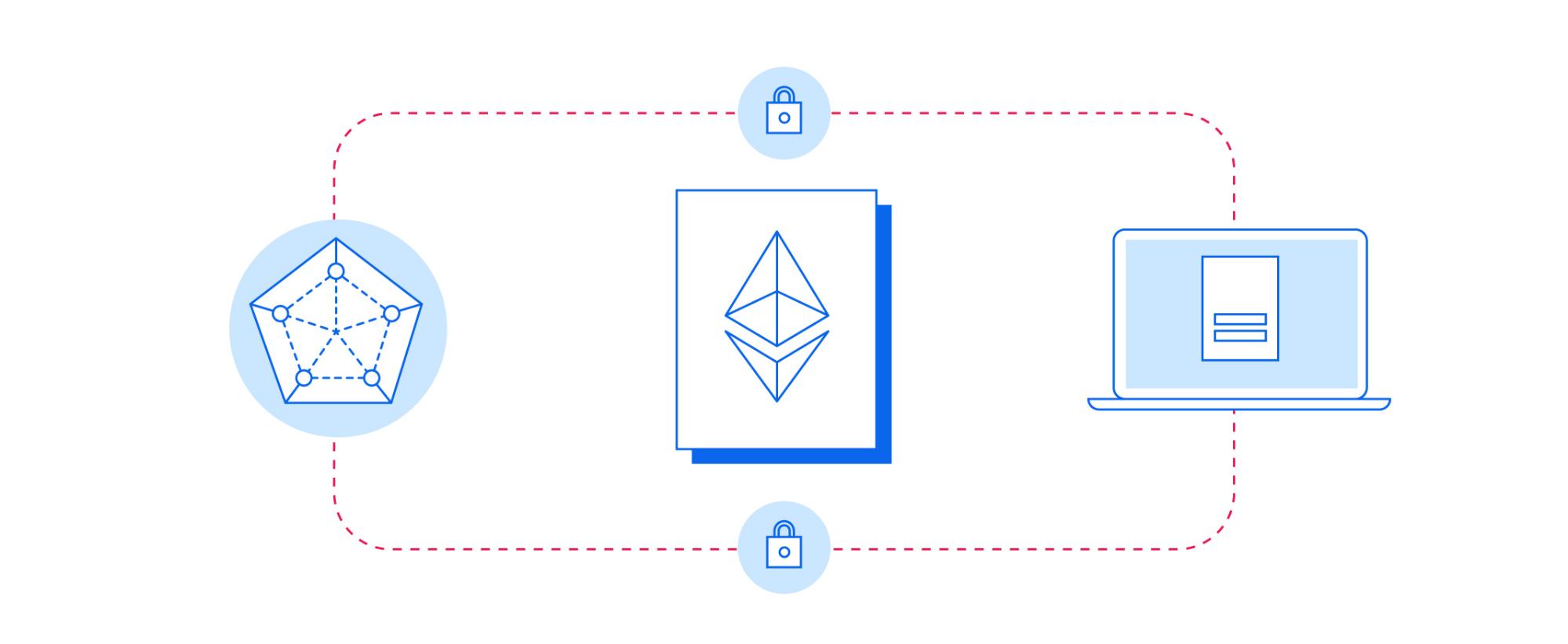

A smart contract is a program that is smart enough to execute a piece

of code instructions when conditions are met. Also, smart contracts do

not require any third-party control and run solely on the basis of

pre-programmed logic which is overseen by a distributed, decentralized

network of computers that runs on blockchain.

It is a computer protocol that is used to digitally and

automatically facilitate, verify, and enforce the terms of a contract.

The main benefit of the Escrow smart contract is to reduce the

dependency of intermediates, centralized arbitrators to help reduce

fraud transactions.

The program automatically validates a condition

and determines whether an asset will go to one person or back to the

person who sent it. It is interesting to know that during the process,

the

distributed ledger

can also store and make a copy of the document which provides added

security and immutability.

Main Advantages of using Escrow Smart Contracts

When the transactions has a low-price and high security, it is here to stay

Smart Contract ruling enforcement

Smart contracts are

enforced the same way as normal programs are done. Smart contracts

are similar to real-world contracts but not exactly. In the real

world, if a contract is broken you can take the person to court but

in the case of smart contracts, there are predefined rules that are

defined by parties and enforced by the blockchain. It’s smart

contract enforcement.

Arbitration Decentralized (reduce conflict interest) with

Kleros

/Aragon:

The arbitration is decentralized and if any conflict of interest

arises, it is being dealt with

Kleros,

a Decentralized Autonomous Organization (DAO) to solve disputes.

Interoperable (switching arbitrator)

Escrow smart contracts are Interoperable that means if you don’t trust the arbitrator you can easily change the arbitrator, being said the smart contract follows the arbitrator standard. It allows a decentralized arbitrator to easily switch from one arbitration service to another one. Or to allow their users to choose themselves their arbitration services.

Resilient

The service is resilient and is here to stay. In other words, the service is always up. With an escrow smart contract, you can be sure that your fund is never lost because it uses blockchain protocol with high availability.

Less Arbitration fees (if the gas is affordable :p)

Smart contracts act as a less expensive way of doing business between two or more parties. In case of any dispute, you just have to pay the arbitration fee. Decentralized arbitrators like Kleros is affordable as decentralized arbitration mixed with crowd sourcing is less expensive. In the case of winning a dispute, you don’t pay the arbitration fee but just gas fees used for transaction.

Use cases where an Escrow plays a major role

1. Recover

Let us see how Recover functions in few easy steps:

- The finder finds your lost valuable.

- The honest finder will definitely return your valuable, but the dishonest person (who is not willing to not return the product) on seeing the reward capped higher than the market price is incentivized to return it to the owner.

- When the item is returned the finder gets the reward.

- If not, a dispute is created which is handled by the arbitrator.

2. Hiring Freelancers

Escrow can work tremendously well when it comes to hiring freelancers for a project. The money is sent to an Escrow and is only released when the expected work is delivered within the time.

Conclusion

Escrow financial agreement not only helps make the transaction secure

but also adds more trust among two parties.

On the other hand, Escrow

smart contracts provide advantages like smart contract enforcement,

interoperability, resilience, and better cost to name a few.

Moreover, the Smart contract can also be secured with

Kleros dispute resolution

which helps the transaction being more secure.

The Recover Loser box comes with all the advantages of

escrow smart contracts with easy implementation to make sure your

valuable is returned, the next time you lose it.

Now that we have

learned briefly how blockchain escrow works, let us discover

Recover.